While this is listed above as a benefit from a time standpoint, the IPO roadshow is a great opportunity to meet with 40-60 investors one-on-one and more through group meetings. While there are some positives, here are some negatives: By becoming publicly traded, companies can use stock as an additional form of currency to cash when making acquisitions.

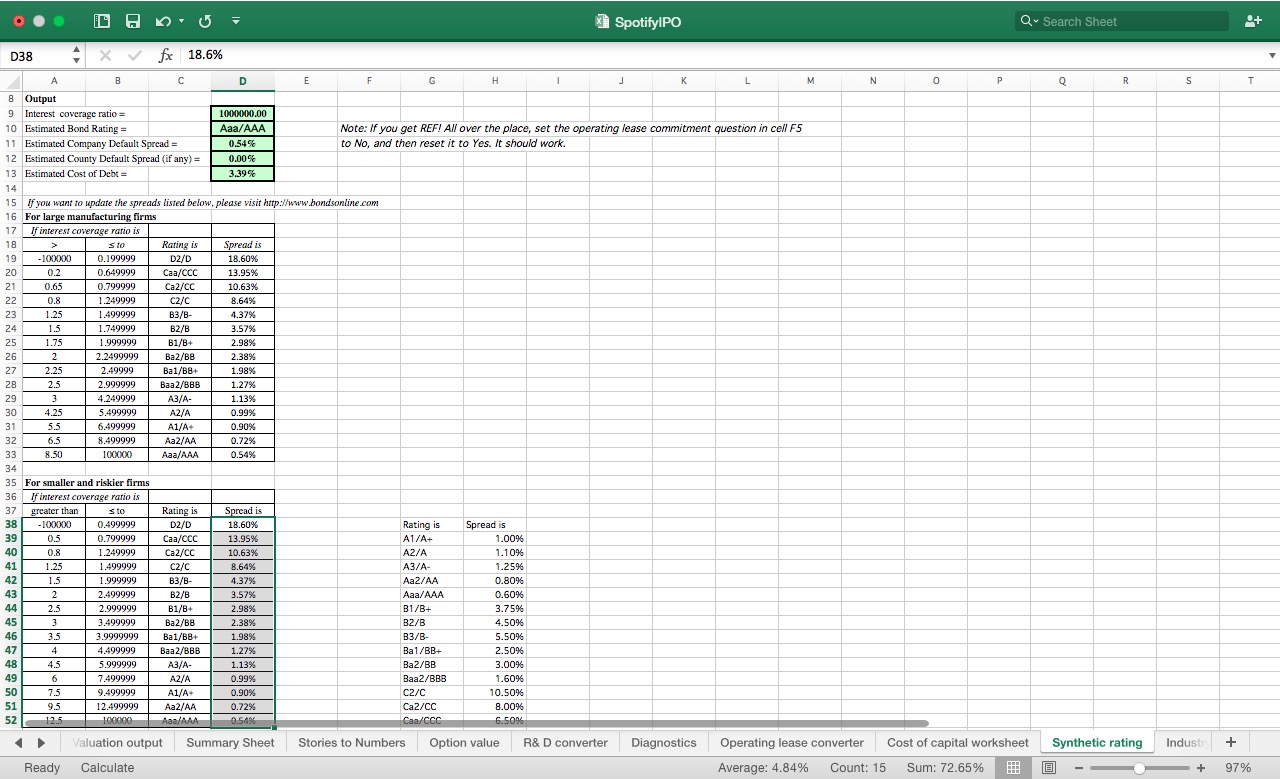

For insiders, this can be a positive as they can sell their shares once the stock has started trading as opposed to the traditional 180-day period in which they can’t. With the company not issuing any primary shares, there is no dilution to existing shareholders. From a management time demand, this can be a benefit, as management will not need to spend time prepping for a roadshow and the two weeks of meetings with investors. While a company may pay as much as a 7% fee to the underwriters on top of fees to company counsel and other underwriting costs, a Direct Listing has smaller fees. Here are some benefits of a Direct Listing: Pros & Cons of a Direct ListingĪ Direct Listing can sound very appealing to a company as it is a way to bypass much of the time and expense of the traditional IPO route. Ultimately the NYSE set a reference price of $132 (just above the $131.88 high from the previous month’s private transactions) before the stock opened at $165.90 and closed at $149.01 on the first day. While this data could have no relation to the opening public price, it also can be used as a factor to help guide the opening. Unlike many private companies, Spotify had a history of private transactions that had taken place over the ten months prior to the NYSE listing. In this role, the banks worked with the Designated Market Maker, Citadel Securities, to find a reference price to guide the opening price on the NYSE. While there were no underwriters in the traditional sense, Spotify did hire Goldman Sachs, Morgan Stanley and Allen & Co. As part of the NYSE requirements for a Direct Listing, only existing shareholders may sell, thus creating a publicly traded company while providing liquidity for existing shareholders only.

However, unlike most IPOs, the company was not selling any shares itself, nor were they receiving any of the proceeds from the offering. In the case of Spotify, the company’s prospectus was for the sale of over 55 million shares. In a traditional public offering the underwriters manage a roadshow and book building process to come to a deal price, whereas in a direct listing the deal price is determined by a reference price and the buy and sell orders on the first day of trading. What is a Direct Listing?Ī Direct Listing is a process in which there is no underwritten public offering managed by a group of banks. based companies, in this post we look at the mechanics, along with some pros and cons, of a Direct Listing. While this remains a rare occurrence for U.S. Direct Public Offerings, or Direct Listings, gained attention in the first half of 2018 when Spotify bypassed the traditional underwritten IPO to list their shares on the New York Stock Exchange (NYSE) through a NYSE Direct Floor Listing.

0 kommentar(er)

0 kommentar(er)